- Home

- News

Newsroom

A. O. Smith Corporation is one of the world's leading manufacturers of residential and commercial water heaters. Browse our latest news, case studies and more.

Media Contacts

Curt Selby

SVP - HR & Public Affairs

Contact Curt with requests for media interviews, comments or appearances by the leadership staff.

For all other inquiries, please use the Contact Us form.

View Posts by Year

June 11, 2025

A. O. Smith Ranked Among America's Climate Leaders

A. O. Smith Corporation, a leader in water heating and water treatment, has made the USA Today America's Climate Leaders list for the second time.

April 29, 2025

A. O. Smith Reports First Quarter 2025 Performance

The company announced Q1 sales of $964 million, a decrease of 2%.

April 25, 2025

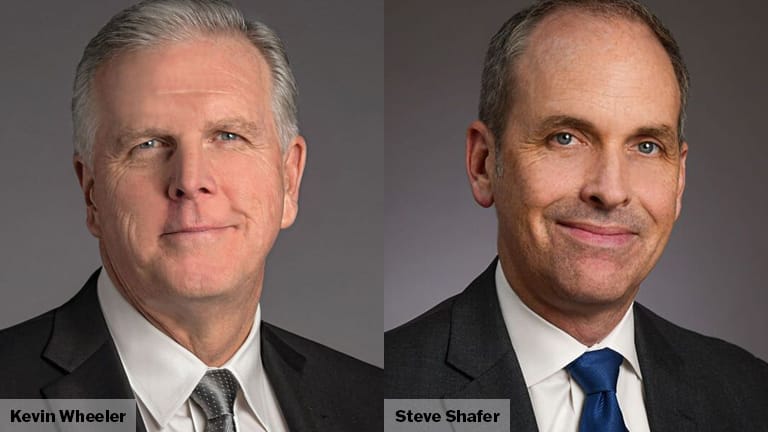

Kevin Wheeler to Become Executive Chairman, Stephen Shafer Named President and Chief Executive Officer

A. O. Smith Announces Kevin Wheeler to Become Executive Chairman, Stephen Shafer Named President and Chief Executive Officer, effective July 1, 2025.

April 8, 2025

A. O. Smith Celebrates Product Development Center Grand Opening

New facility promotes collaboration, sustainability and innovation

April 7, 2025

A. O. Smith Reports Quarterly Dividend

Cash dividend of $0.34 per share payable on Thursday, May 15, 2025 to shareholders of record Wednesday, April 30, 2025.

April 2, 2025

A. O. Smith to Hold First Quarter Conference Call on April 29, 2025

A. O. Smith will release its first quarter 2025 financial results before the market opens on April 29 and has scheduled an investor conference call to follow at 10:00 a.m. (Eastern Time).

January 30, 2025

A. O. Smith Reports 2024 Performance and Introduces 2025 Guidance

The company announced 2024 sales of $3.8 billion, a decrease of 1%.

January 16, 2025

A. O. Smith Reports Quarterly Dividend

Cash dividend of $0.34 per share payable on Tuesday, Feb. 18 to shareholders of record Friday, Jan. 31, 2025.

January 03, 2025

A. O. Smith to Hold Fourth Quarter Conference Call on January 30, 2025

A. O. Smith will release its fourth quarter 2024 financial results before the market opens on Thursday, Jan. 30, and has scheduled an investor conference call to follow at 10:00 a.m. (Eastern Time).

Looking for A. O. Smith Corporation’s Financial Release information?

Visit our A. O. Smith Investor Relations site to view A. O. Smith’s Financial Release information and more.